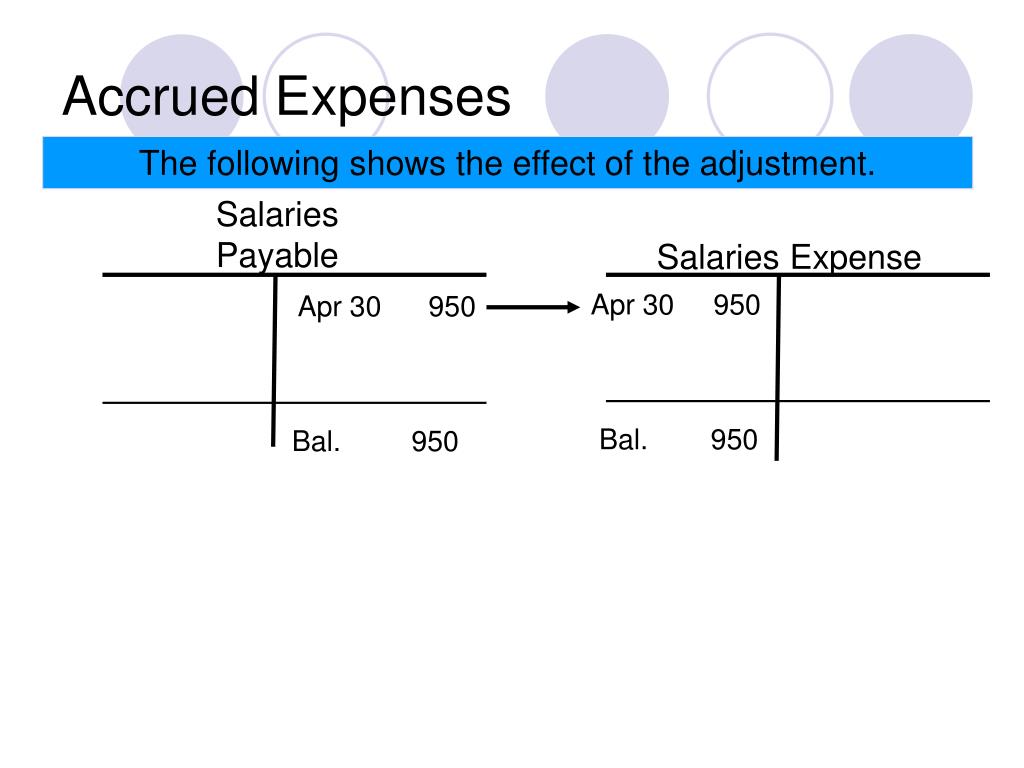

The adjusting entry for an accrued expense updates the Wages Expense and Wages Payable balances so they are accurate at the end of the month. Here are the Wages Payable and Wages Expense ledgers AFTER the adjusting entry has been posted. Wages Expense is debited on 6/30, but Cash cannot be credited since 6/30 is a Tuesday and employees will not be paid until Friday. This entry splits the wages expense for that week: two days belong in June, and the other three days belong in July. Therefore, for this week, $400 of the $1,000 for the week should be a June expense and the other $600 should be a July expense.Īn adjusting entry is required on June 30 so that the wages expense incurred on June 29 and June 30 appears on the June income statement. Employees earn $1,000 per week, or $200 per day. The Friday after, when the company will pay employees next, is July 3. ▲ Interest Payable is a liability account that is increasing.Īn expense is a cost of doing business, and it cost $4,000 in wages this month to run the business.Īdjusting journal entry: Assume that June 30, the last day of the month, is a Tuesday. ▲ Interest Expense is an expense account that is increasing. ▲ Taxes Payable is a liability account that is increasing. ▲ Taxes Expense is an expense account that is increasing. ▲ Wages Payable is a liability account that is increasing. ▲ Wages Expense is an expense account that is increasing. These are the three adjusting entries for accrued expenses we will cover. You credit an appropriate payable, or liability account, to indicate on your balance sheet that you owe this amount.

For the adjusting entry, you debit the appropriate expense account for the amount you owe through the end of the accounting period so this expense appears on your income statement. However, if the end of an accounting period arrives before you record any of these growing expenses, you will make an adjusting entry to include the part of the expense that belongs in that period and on that period’s financial statements.

Accrued expenses payable full#

This may occur with employee wages, property taxes, and interest-what you owe is growing over time, but you typically don’t record a journal entry until you incur the full expense. The transaction is in progress, and the expense is building up (like a “tab”), but nothing has been written down yet. In this case someone is already performing a service for you but you have not paid them or recorded any journal entry yet. \)Īccrued expenses require adjusting entries.

0 kommentar(er)

0 kommentar(er)